Egyptian instability is crushing Kenya’s economy

Kenya, lacking mineral or oil resources, is an agricultural economy. Specifically, they are really good at growing tea, and, to a lesser extent, coffee. This helps explain why Kenya’s developmental trajectory has been far more successful than that of other economies. Tea production is labor intensive and often depends on small and mid-sized farms which employ lots of people. Instead of money flowing in the pockets of the corrupt, who often squirrel it away in overseas accounts, money goes directly in the pockets of growers.

Kenya is the UK’s biggest tea supplier, but Egypt buys more tea by volume from Kenya than any other country. A piece in Think Africa Press today wrote on the dual problem of falling demand for tea from Egypt due to prolonged unrest, and that of falling commodity prices worldwide.

The cause of the farmers’ problems lies far to the north of the cool, tea-covered slopes of the Aberdares, in the heat of Cairo and the continuing fallout from the Arab Spring. In 2010, the last year before the uprising in Egypt, Kenya supplied the tea-obsessed UK with around half of its tea, but Egypt was the the single largest destination for Kenyan tea exports, buying nearly a fifth of what the factories around Nyeri produce. With the overthrow of President Mohammed Morsi in July 2013 and the ongoing campaign against the Muslim Brotherhood causing continued political instability, demand has plummeted and prices have gone with them.

“It’s a supply and demand issue,” says Chai Kiarie, Field Services Manager at Gitugi Tea Factory. “We produced more tea this year, but we still made nearly $2 million less than we did last year. With these problems abroad, the demand just isn’t there.”

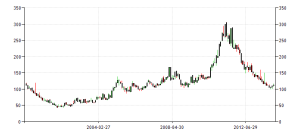

This isn’t an isolated problem. Coffee prices, once riding high on a boom in commodity prices have been steadily falling since the financial collapse. The commodity boom was a winning sitaution for African economies and helped drive much of the rapid growth seen throughout the 00’s. Regulation has started curbing speculative practices that drove the increases, removing a source of destructive volatility which drove up food prices in developing countries, but has also decreased badly needed foreign exchange revenues.

I visited a few farms the last time I was in Kenya. Farmers aren’t waiting around for subsidies to help pull them out of a potential mess. All of the farmers I spoke with are looking for new ways to diversify their operations and meet potentially lucrative world wide demand for competitive products. All of them wanted to think of ways to increase productivity while decreasing the cost of inputs. The pressures from falling tea demand could help push them to find ways to innovate and increase both revenues and stability.